I’ve been using Uber quite frequently over the last couple of months and today’s Mumbai taxi strike to protest such services ironically forced me to opt for Uber at a 1.8x surge price. While I’ve had my share of ups & downs with Uber, the flexible pricing model has been one aspect that I’ve been impressed with compared to the competition like Ola.

Uber managed to create quite a buzz offering single digit per km rates which was almost half the rate others were offering at that time, but the pricing model which included a per minute charge on the trip ensured that the overall fare was not unsustainably low. This has also allowed them to go after the local taxi & auto services in the different cities and they also end up being cheaper for medium to long distances.

The Uber pricing in India is typically a low per km rate coupled with another per trip minute rate on top of a fixed base fare, with the overall fare subject to a minimum amount and of course the surge factor. Putting it simply:

Fare = Surge factor x (Distance x Rate per km + Trip time in minutes x Rate per minute)

Ola which had started off in India with a conventional pricing model of rate per km and a waiting time rate has pretty much overhauled their pricing to mimic the Uber model. They have in fact abandoned their initial method of applying a fixed peak time price during 2 slots on weekdays in favour of a surge factor. The other taxi services like Meru, Tab Cab, Easy Cab etc. have thus far stuck to the traditional model, though they’re trying to stay relevant through special offers.

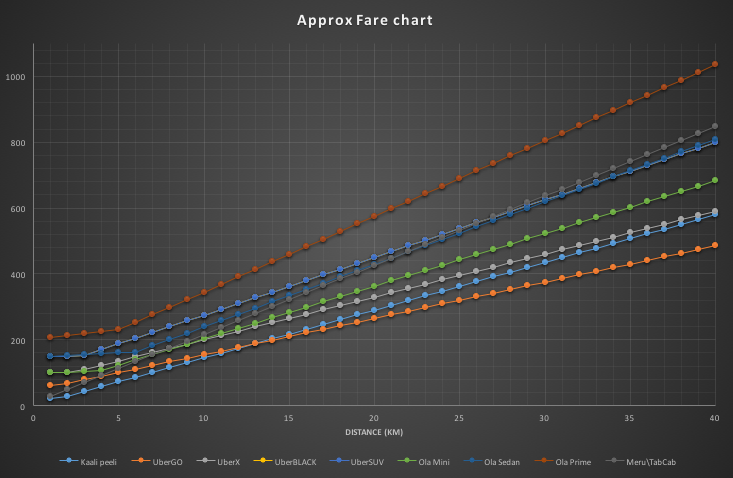

I also did a simplistic analysis of how the different services compare in terms of the trip fare in a city like Mumbai (Google Sheet here). I’ve assumed a trip time of 3 minutes per km and waiting time of 1 minute for every 4 km, so the results are going to be quite different in heavy traffic.

For short distances, the local kaali peelis are of course the cheapest, but for distances above 10 km, UberGO ends up being a better deal. The next cheapest is the Ola mini which starts getting pretty competitive with kaali peelis after the 20 km mark. This is of course disregarding the non-AC nature of the kaali peelis. [Update] Ola Mini and UberX are pretty competitive till the 10 km range, but separate pretty quickly after that as the near 30% higher charge per km for Ola starts making a mark.

The older generation of Meru, Tab Cab etc manage to remain competitive with the newer lot, matching the next best Ola Sedan UberX and Ola up to the 10 km mark, but the higher cost per km quickly multiplies beyond that point. And then we have UberBLACK and UberSUV which have the same rates but different capacities. They can actually offer a better deal than Meru and the likes for long distances over 25 km. Of course if you have 5-6 people travelling, then these 6 seaters are the way to go. Lastly, we have Ola’s version of the SUV with its Prime service that’s the costliest of the lot. Again, if you are in a group of 5-6 people, this can actually be cheaper than the taking two 4-seater vehicles, unless of course you manage to get a couple of UberGOs.

I haven’t considered the surge pricing in the above comparison, and that is a scenario where the older lot turns out to be cheaper. However, such scenarios are rare as Merus and the likes can be pretty hard to find for immediate travel. The interesting thing to see now will be the role that regulators play in toying around with these pricing models.

Update (16 Jun 2015): Found a major miscalculation in the trip time. I have corrected the graph and updated the text accordingly.

3 thoughts on “How Uber’s shaken up the pricing structure in India”

Comments are closed.